What is Review Alliance?

We create streamlined bank compliance reviews for community banks.

What Need Does R/A Fill?

We’ve assembled a team of seasoned professionals who understand the nuances of community banking. Our experience with banks large and small helps us understand the scope of work required and focus on the details. We know your bank and its unique procedures, policies, and processes — our goal is to ensure your processes result in compliance.

How Would a Cycle

of Reviews Work?

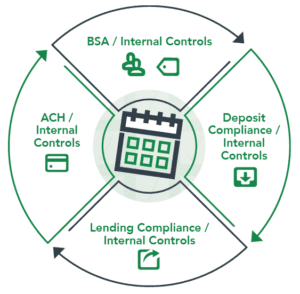

The typical small bank review cycle revolves around four main areas reviewed on a quarterly basis with Internal Controls done every quarter as a strategy for managing the overall process.

Can You Explain

The R/A Process?

Because every bank is different—staffing, processes, policies; even Boards—our goal is to make our process fit yours.

Here’s how we do it:

Risk Assessment

R/A will do a complete survey to determine what needs the institution has and what must be addressed first

Review Prep

Checklist and forms are delivered so requested documents can be gathered and/or documents prepared

Onsite Review

R/A’s team will visit your bank onsite to gather additional documents, complete checklists, and generate the review.

Report Generation

Our team creates the first report based on findings and bank materials. The key to our service is the fast turn-around for this report – the target is 45-60 days.

Review & Respond

Bank management reviews R/A’s initial report and responds to these findings.

Final Report

Delivered to the Board, this is typically done by calling-in during a monthly or quarterly meeting.

Still Have Questions?

No doubt you do—this is an important decision. And whether you have real reporting issues you’re facing or whether you’re trying to build compliant programs that will stand up to examination, when you call Review Alliance, you are talking to experts with decades of experience.

Contact our Membership team at (833) 683-0701 or by email at: [email protected]